Stock & ETF Data

US stock and ETF data, simplified.

Access real-time prices, historical data, and fundamentals for every listed stock and ETF—via API or Google Sheets.

Market Data Stock APIs

Simple to Use, Quick to Deploy, Easy to Adapt

Get market data into your applications without the overhead. Our APIs are designed for speed, clarity, and flexibility—so you can focus on building, not debugging.

/v1/stocks/quotes/{symbol}

Unlock the U.S. Stock Markets

Get fast, responsive pricing for U.S. equities—ideal for apps, dashboards, and tools that need consistent, up-to-the-minute quote data.

- Live pricing for any U.S. stock

- Last trade, daily & percent change included

- 52-week high/low optional

- Optional intraday-updated daily candle information.

{

"s": "ok",

"symbol": ["AAPL"],

"ask": [182.12],

"askSize": [3],

"bid": [182.1],

"bidSize": [3],

"mid": [182.11],

"last": [182.1],

"change": [-0.3],

"changepct": [-0.0016],

"volume": [4051215],

"o": [182.85],

"h": [182.96],

"l": [181.93],

"c": [182.1],

"52weekHigh": [199.62],

"52weekLow": [164.08],

"updated": [1715175712]

}{

"s": "ok",

"symbol": ["AAPL"],

"ask": [182.12],

"askSize": [3],

"bid": [182.1],

"bidSize": [3],

"mid": [182.11],

"last": [182.1],

"change": [-0.3],

"changepct": [-0.0016],

"volume": [4051215],

"o": [182.85],

"h": [182.96],

"l": [181.93],

"c": [182.1],

"52weekHigh": [199.62],

"52weekLow": [164.08],

"updated": [1715175712]

}/v1/stocks/candles/{resolution}/{symbol}

Supercharge your Charts & Analysis

Access robust, high-quality candlestick data to power your charting and analysis tools. One simple endpoint gives you flexible access to intraday and daily pricing, with full support for historical and recent trading activity.

- Flexible daily and intraday resolutions—1 minute to 1 year

- High-quality daily & intraday candles, updated throughout the trading day.

- Choose between as-traded or split-adjusted historical data

- Covers both regular and extended hours sessions

- Query by start/end, relative dates, or fixed count

{

"s": "ok",

"o": [221.03,

218.55,

220],

"h": [222.49,

221.5,

220.94],

"l": [217.19,

217.14,

218.83],

"c": [217.68,

221.03,

219.89],

"v": [33463820,

24018876,

20730608],

"t": [1569297600,

1569384000,

1569470400]

}{

"s": "ok",

"o": [221.03,

218.55,

220],

"h": [222.49,

221.5,

220.94],

"l": [217.19,

217.14,

218.83],

"c": [217.68,

221.03,

219.89],

"v": [33463820,

24018876,

20730608],

"t": [1569297600,

1569384000,

1569470400]

}/v1/stocks/earnings/{symbol}

Take Control of Quarterly Earnings

Don't let earnings sneak up on you. Get programmatic access to earnings reports, including reporting dates, analyst EPS estimates, earnings surprises, and more. Enhance your financial analysis with comprehensive data on reported and estimated earnings per share.

- Includes analyst EPS estimates, allowing for direct comparison with reported figures

- Earnings data for each fiscal quarter, ensuring comprehensive coverage throughout the year

- Surprise EPS values and their percentage differences for performance evaluation

- Dates of earnings reports and expected report times for precise planning

{ "s": "ok",

"symbol":

["AAPL", "AAPL", "AAPL", "AAPL"],

"fiscalYear":

[2023, 2023, 2023, 2023],

"fiscalQuarter":

[1, 2, 3, 4],

"date":

["2022-12-31", "2023-03-31", "2023-06-30", "2023-09-30"],

"reportDate":

["2023-02-02", "2023-05-04", "2023-08-03", "2023-11-02"],

"reportTime":

["after close", "after close", "after close", "after close"],

"currency":

["USD", "USD", "USD", "USD"],

"reportedEPS":

[1.88, 1.52, 1.26, 1.46],

"estimatedEPS":

[1.94, 1.43, 1.19, 1.39],

"surpriseEPS":

[-0.06, 0.09, 0.07, 0.07],

"surpriseEPSpct":

[-0.0309, 0.0629, 0.0588, 0.0504],

"updated":

["2024-05-09", "2024-05-09", "2024-05-09", "2024-05-09"]}{ "s": "ok",

"symbol":

["AAPL", "AAPL", "AAPL", "AAPL"],

"fiscalYear":

[2023, 2023, 2023, 2023],

"fiscalQuarter":

[1, 2, 3, 4],

"date":

["2022-12-31", "2023-03-31", "2023-06-30", "2023-09-30"],

"reportDate":

["2023-02-02", "2023-05-04", "2023-08-03", "2023-11-02"],

"reportTime":

["after close", "after close", "after close", "after close"],

"currency":

["USD", "USD", "USD", "USD"],

"reportedEPS":

[1.88, 1.52, 1.26, 1.46],

"estimatedEPS":

[1.94, 1.43, 1.19, 1.39],

"surpriseEPS":

[-0.06, 0.09, 0.07, 0.07],

"surpriseEPSpct":

[-0.0309, 0.0629, 0.0588, 0.0504],

"updated":

["2024-05-09", "2024-05-09", "2024-05-09", "2024-05-09"]}/v1/stocks/news/{symbol}

Get The Why Behind Each Move

Get a steady stream of headlines and summaries from trusted sources, helping users stay current on what’s moving the market. Ideal for personal dashboards, watchlists, or chart annotations.

- Query by date range or request a specific number of headlines

- Includes headline, content excerpt, and source URL for each story

- Delivered as HTML for easy display in personal tools and apps

{

"s": "ok",

"symbol": [

"AAPL",

"AAPL"],

"headline": [

"iPhone Exports From India Double, Predicted To Hit Record $13B This Year As Apple's Pivot Away From China Pays Off",

"Warren Buffett's $189 Billion Subtle Warning to Wall Street Shouldn't Be Ignored"],

"content": [

"iPhone Exports From India Double, Predicted To Hit Record $13B This Year As Apple's Pivot Away From China Pays Off<br /><br />This story was first published on the Benzinga India portal.<br /><br />Apple Inc. (NASDAQ: AAPL) has reported a remarkable surge in its iPhone exports from India, with the figures for April nearly doubling to $1.1 billion, up from $580 million in the previous year.<br /><br />As reported by The Economic Times, this robust start has stimulated predictions that Apple's exports could surpass the $13 billion mark, solidifying India's place as its second-largest iPhone manufacturing hub after China. Presently, approximately 14%-15% of Apple’s total iPhone production occurs in India, with projections to reach 26% by 2026.<br /><br />In FY2024, Apple's total production in India reached $14 billion, with exports making up over $10 billion. This represents the highest annual export value by any company in India.<br /><br />See Also: Airtel, Google Cloud Join Forces To Accelerate Cloud Adoption And AI In India<br /><br />Apple operates through its contract manufacturers Foxconn, Wistron, and Pegatron, all of which benefit from India's production-linked incentive (PLI) scheme. Foxconn is leading the way in exports, managing more than 70% of the shipments. Wistron, now owned by Tata Group, and Pegatron, currently in discussions for a majority stake sale to Tata, also contribute significantly.<br /><br />April's surge indicates that Apple might surpass the fourth-year targets of the PLI scheme. While Apple and a few other companies, such as Samsung and Dixon Technologies, consistently meet PLI targets, many beneficiaries grapple with achieving their set goals. Meanwhile, Apple’s market presence in India is steadily increasing, with a 38% YoY growth and aspirations to elevate its local market share into double digits from around 7% in FY24.<br /><br />If you’d like to stay ahead of the curve on the Indian market, sign up for our Ring The Bell newsletter by clicking here.<br /><br />\"ACTIVE INVESTORS' SECRET WEAPON\" Supercharge Your Stock Market Game with the #1 \"news & everything else\" trading tool: Benzinga Pro - Click here to start Your 14-Day Trial Now!<br /><br />Get the latest stock analysis from Benzinga?<br /><br />This article iPhone Exports From India Double, Predicted To Hit Record $13B This Year As Apple's Pivot Away From China Pays Off originally appeared on Benzinga.com<br /><br />© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.<br /><br />View comments",

"Investors are never lacking for data on Wall Street. We're currently in the heart of earnings season, and economic data continues to be reported on a near-daily basis. But arguably the most important data release of the quarter is set to occur this Wednesday, May 15. This marks the deadline for institutional money managers to file Form 13F with the Securities and Exchange Commission.<br /><br />A 13F provides an over-the-shoulder snapshot of what Wall Street's brightest minds, with at least $100 million in assets under management, have been buying, selling, and holding in the most recent quarter -- in this instance, the March-ended quarter. It's not uncommon for professional and everyday investors to follow in the footsteps of Wall Street's most-successful asset managers. Image source: Getty Images.<br /><br />But you don't have to wait until this coming Wednesday to get a sneak peak at what some of Wall Street's most-prominent asset managers have been up to. Thanks to interviews, annual meetings, and earnings releases, select billionaire investors have revealed selling activity in three ultra-popular stocks during the first quarter.<br /><br />Stanley Druckenmiller sells shares of Nvidia<br /><br />The first widely owned stock that was given at least a partial heave-ho during the March-ended quarter is semiconductor titan Nvidia(NASDAQ: NVDA). In a recent interview on CNBC's Squawk Box, Druckenmiller admitted that his fund, Duquesne Family Office, cut its position in Nvidia in \"late March.\" For context, Duquesne Family Office held 617,494 shares of Nvidia, along with 489,500 Nvidia call options, as of Dec. 31, 2023.<br /><br />Although Druckenmiller believes the value of artificial intelligence (AI) for corporate America may be undervalued looking five years into the future, he admits that near-term hype may have gotten ahead of itself for AI stocks, including Nvidia.<br /><br />For the moment, Nvidia's A100 and H100 graphics processing units (GPUs) are the undisputed top choice by businesses operating AI-accelerated data centers. In particular, the H100 is powering generative AI solutions and helping to train large language models.<br /><br />However, the coming 12 months could prove especially challenging for the backbone of the AI revolution.<br /><br />For starters, competition is coming at Nvidia from all angles. Advanced Micro Devices and Intel have AI-accelerators designed to go toe-to-toe with Nvidia's H100 in enterprise data centers.<br /><br />Meanwhile, Nvidia's top four customers (roughly 40% of net sales), which are members of the \"Magnificent Seven,\" are all developing AI-GPUs of their own. Even if these chips are complementary to Nvidia's H100 GPUs, it seems highly likely that the Magnificent Seven will be far less reliant on Nvidia's AI infrastructure beyond 2024.<br /><br />Story continues<br /><br />Last year, AI-GPU scarcity was the driving force behind Nvidia's 217% sales growth from its Data Center segment. But as AMD, Intel, and other Magnificent Seven companies deploy their own chips, Nvidia could struggle to maintain its otherworldly pricing power on its GPUs.<br /><br />The final nail in the coffin is that every next-big-thing investment trend for three decades has endured a bubble in its early innings of expansion. It's incredibly likely that investors will, once again, overestimate the adoption of a new technology. If history repeats itself and the AI bubble bursts, no company will be hit harder than Nvidia. Berkshire Hathaway CEO Warren Buffett. Image source: The Motley Fool.<br /><br />Warren Buffett dumps Paramount Global<br /><br />Another billionaire investor that let the cat out of the bag before releasing a required 13F is Berkshire Hathaway CEO Warren Buffett. During his company's annual shareholder meeting on May 4, the \"Oracle of Omaha\" confessed that all shares of media behemoth Paramount Global(NASDAQ: PARA) -- 63,322,491 shares, as of Dec. 31, 2023 -- were sold at a loss during the first quarter.<br /><br />Buffett typically approaches his investments outside of the financial sector with a focus on consumer habits. His thesis was likely that a rebound in advertising for Paramount's TV network segment, coupled with a lengthy history of consumers gobbling up traditional and streamed content, would allow Paramount to regain its luster. Unfortunately, this failed to come to fruition.<br /><br />Like most legacy media companies, Paramount has struggled to make its direct-to-consumer segment profitable. The costs associated with building its content library and marketing its streaming network have weighed on its bottom line.<br /><br />But if there's a silver lining here, it's that global DTC subscriber count and average revenue per user are climbing, which suggests that Paramount has been successful in raising subscription prices without scaring away its members. The company noted that year-over-year operating losses before depreciation and amortization have shrunk in each of the last four quarters for its DTC segment.<br /><br />The advertising environment has been challenging, as well. Last year, a couple of predictive indicators, such as the first sizable decline in U.S. M2 money supply since the Great Depression, signaled a high probability of the U.S. falling into a recession. Advertisers often front-run economic weakness by reducing their spending. Weaker ad revenue has undeniably hurt Paramount's legacy TV network.<br /><br />There's also been concern about Paramount's ability to service its $14.6 billion in long-term debt ($12.2 billion in net debt). Unless the company can substantially lessen its streaming losses, it's going to be difficult to silence critics.<br /><br />The \"Oracle of Omaha\" also pared back Berkshire's stake in Apple<br /><br />The Oracle of Omaha's selling didn't end with Paramount Global. Although we have to wait a few more days to get the complete story, Berkshire Hathaway's first-quarter operating results show that a sizable chunk -- about 115 million shares -- of the company's stake in tech stock Apple(NASDAQ: AAPL) was given the heave-ho.<br /><br />In addition to Berkshire's operating results spilling the beans, Buffett freely admitted during his company's annual shareholder meeting that he and his investment team pared down this mammoth stake in the March-ended quarter. He justified this reduction by pointing to corporate tax rates. Buffett opined that investors would come to appreciate Berkshire locking in gains at a 21% peak corporate tax rate given the likelihood that corporate tax rates rise in the future.<br /><br />Despite jettisoning around 13% of his company's stake in Apple, Warren Buffett still views the company as Berkshire's best business.<br /><br />Apple has an exceptionally loyal base of customers, and it's frequently led with innovation. CEO Tim Cook has successfully overseen the development of domestic market share-leading iPhones, as well as Apple's transformation to a platform's company.<br /><br />But if you asked Warren Buffett what his favorite thing is about Apple, it might very well be the company's unsurpassed capital-return program. Apple is on track to dole out a little over $15.4 billion in dividends to its shareholders this year, and has repurchased $674 billion worth of its common stock since initiating a buyback program in 2013. Buffett loves buybacks because they can incrementally increase the ownership stakes of long-term investors.<br /><br />However, Apple isn't immune to headwinds. Following a modest sales decline in fiscal 2023 (Apple's fiscal year ends in late September), the second-largest public company by market cap has seen its net sales slip by less than 1% through the first half of the current fiscal year. While subscription services revenue has been strong, physical product sales remain weak.<br /><br />Furthermore, while modest cost-cutting and an aggressive share repurchase program have kept earnings per share (EPS) moving in the right direction, a deeper dive into Apple's net income shows the company's growth engine has stalled.<br /><br />Apple was a bargain when it was delivering sustained double-digit sales growth and trading at a multiple of 10 to 15 times forward-year EPS. But at 27 times forward-year EPS and with sales going nowhere, this Wall Street darling looks to be losing its sheen.<br /><br />Should you invest $1,000 in Nvidia right now?<br /><br />Before you buy stock in Nvidia, consider this:<br /><br />The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.<br /><br />Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $550,688!*<br /><br />Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. TheStock Advisorservice has more than quadrupled the return of S&P 500 since 2002*.<br /><br />See the 10 stocks »<br /><br />*Stock Advisor returns as of May 6, 2024<br /><br />Sean Williams has positions in Intel. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Berkshire Hathaway, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.<br /><br />3 Ultra-Popular Stocks Billionaire Investors Are Selling was originally published by The Motley Fool<br /><br />View comments",],

"source": [

"https://finance.yahoo.com/news/iphone-exports-india-double-predicted-113756676.html",

"https://finance.yahoo.com/news/warren-buffetts-189-billion-subtle-084100685.html"],

"publicationDate": [

1715572800,

1715572800],

"updated": 1715572800

}{

"s": "ok",

"symbol": [

"AAPL",

"AAPL"],

"headline": [

"iPhone Exports From India Double, Predicted To Hit Record $13B This Year As Apple's Pivot Away From China Pays Off",

"Warren Buffett's $189 Billion Subtle Warning to Wall Street Shouldn't Be Ignored"],

"content": [

"iPhone Exports From India Double, Predicted To Hit Record $13B This Year As Apple's Pivot Away From China Pays Off<br /><br />This story was first published on the Benzinga India portal.<br /><br />Apple Inc. (NASDAQ: AAPL) has reported a remarkable surge in its iPhone exports from India, with the figures for April nearly doubling to $1.1 billion, up from $580 million in the previous year.<br /><br />As reported by The Economic Times, this robust start has stimulated predictions that Apple's exports could surpass the $13 billion mark, solidifying India's place as its second-largest iPhone manufacturing hub after China. Presently, approximately 14%-15% of Apple’s total iPhone production occurs in India, with projections to reach 26% by 2026.<br /><br />In FY2024, Apple's total production in India reached $14 billion, with exports making up over $10 billion. This represents the highest annual export value by any company in India.<br /><br />See Also: Airtel, Google Cloud Join Forces To Accelerate Cloud Adoption And AI In India<br /><br />Apple operates through its contract manufacturers Foxconn, Wistron, and Pegatron, all of which benefit from India's production-linked incentive (PLI) scheme. Foxconn is leading the way in exports, managing more than 70% of the shipments. Wistron, now owned by Tata Group, and Pegatron, currently in discussions for a majority stake sale to Tata, also contribute significantly.<br /><br />April's surge indicates that Apple might surpass the fourth-year targets of the PLI scheme. While Apple and a few other companies, such as Samsung and Dixon Technologies, consistently meet PLI targets, many beneficiaries grapple with achieving their set goals. Meanwhile, Apple’s market presence in India is steadily increasing, with a 38% YoY growth and aspirations to elevate its local market share into double digits from around 7% in FY24.<br /><br />If you’d like to stay ahead of the curve on the Indian market, sign up for our Ring The Bell newsletter by clicking here.<br /><br />\"ACTIVE INVESTORS' SECRET WEAPON\" Supercharge Your Stock Market Game with the #1 \"news & everything else\" trading tool: Benzinga Pro - Click here to start Your 14-Day Trial Now!<br /><br />Get the latest stock analysis from Benzinga?<br /><br />This article iPhone Exports From India Double, Predicted To Hit Record $13B This Year As Apple's Pivot Away From China Pays Off originally appeared on Benzinga.com<br /><br />© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.<br /><br />View comments",

"Investors are never lacking for data on Wall Street. We're currently in the heart of earnings season, and economic data continues to be reported on a near-daily basis. But arguably the most important data release of the quarter is set to occur this Wednesday, May 15. This marks the deadline for institutional money managers to file Form 13F with the Securities and Exchange Commission.<br /><br />A 13F provides an over-the-shoulder snapshot of what Wall Street's brightest minds, with at least $100 million in assets under management, have been buying, selling, and holding in the most recent quarter -- in this instance, the March-ended quarter. It's not uncommon for professional and everyday investors to follow in the footsteps of Wall Street's most-successful asset managers. Image source: Getty Images.<br /><br />But you don't have to wait until this coming Wednesday to get a sneak peak at what some of Wall Street's most-prominent asset managers have been up to. Thanks to interviews, annual meetings, and earnings releases, select billionaire investors have revealed selling activity in three ultra-popular stocks during the first quarter.<br /><br />Stanley Druckenmiller sells shares of Nvidia<br /><br />The first widely owned stock that was given at least a partial heave-ho during the March-ended quarter is semiconductor titan Nvidia(NASDAQ: NVDA). In a recent interview on CNBC's Squawk Box, Druckenmiller admitted that his fund, Duquesne Family Office, cut its position in Nvidia in \"late March.\" For context, Duquesne Family Office held 617,494 shares of Nvidia, along with 489,500 Nvidia call options, as of Dec. 31, 2023.<br /><br />Although Druckenmiller believes the value of artificial intelligence (AI) for corporate America may be undervalued looking five years into the future, he admits that near-term hype may have gotten ahead of itself for AI stocks, including Nvidia.<br /><br />For the moment, Nvidia's A100 and H100 graphics processing units (GPUs) are the undisputed top choice by businesses operating AI-accelerated data centers. In particular, the H100 is powering generative AI solutions and helping to train large language models.<br /><br />However, the coming 12 months could prove especially challenging for the backbone of the AI revolution.<br /><br />For starters, competition is coming at Nvidia from all angles. Advanced Micro Devices and Intel have AI-accelerators designed to go toe-to-toe with Nvidia's H100 in enterprise data centers.<br /><br />Meanwhile, Nvidia's top four customers (roughly 40% of net sales), which are members of the \"Magnificent Seven,\" are all developing AI-GPUs of their own. Even if these chips are complementary to Nvidia's H100 GPUs, it seems highly likely that the Magnificent Seven will be far less reliant on Nvidia's AI infrastructure beyond 2024.<br /><br />Story continues<br /><br />Last year, AI-GPU scarcity was the driving force behind Nvidia's 217% sales growth from its Data Center segment. But as AMD, Intel, and other Magnificent Seven companies deploy their own chips, Nvidia could struggle to maintain its otherworldly pricing power on its GPUs.<br /><br />The final nail in the coffin is that every next-big-thing investment trend for three decades has endured a bubble in its early innings of expansion. It's incredibly likely that investors will, once again, overestimate the adoption of a new technology. If history repeats itself and the AI bubble bursts, no company will be hit harder than Nvidia. Berkshire Hathaway CEO Warren Buffett. Image source: The Motley Fool.<br /><br />Warren Buffett dumps Paramount Global<br /><br />Another billionaire investor that let the cat out of the bag before releasing a required 13F is Berkshire Hathaway CEO Warren Buffett. During his company's annual shareholder meeting on May 4, the \"Oracle of Omaha\" confessed that all shares of media behemoth Paramount Global(NASDAQ: PARA) -- 63,322,491 shares, as of Dec. 31, 2023 -- were sold at a loss during the first quarter.<br /><br />Buffett typically approaches his investments outside of the financial sector with a focus on consumer habits. His thesis was likely that a rebound in advertising for Paramount's TV network segment, coupled with a lengthy history of consumers gobbling up traditional and streamed content, would allow Paramount to regain its luster. Unfortunately, this failed to come to fruition.<br /><br />Like most legacy media companies, Paramount has struggled to make its direct-to-consumer segment profitable. The costs associated with building its content library and marketing its streaming network have weighed on its bottom line.<br /><br />But if there's a silver lining here, it's that global DTC subscriber count and average revenue per user are climbing, which suggests that Paramount has been successful in raising subscription prices without scaring away its members. The company noted that year-over-year operating losses before depreciation and amortization have shrunk in each of the last four quarters for its DTC segment.<br /><br />The advertising environment has been challenging, as well. Last year, a couple of predictive indicators, such as the first sizable decline in U.S. M2 money supply since the Great Depression, signaled a high probability of the U.S. falling into a recession. Advertisers often front-run economic weakness by reducing their spending. Weaker ad revenue has undeniably hurt Paramount's legacy TV network.<br /><br />There's also been concern about Paramount's ability to service its $14.6 billion in long-term debt ($12.2 billion in net debt). Unless the company can substantially lessen its streaming losses, it's going to be difficult to silence critics.<br /><br />The \"Oracle of Omaha\" also pared back Berkshire's stake in Apple<br /><br />The Oracle of Omaha's selling didn't end with Paramount Global. Although we have to wait a few more days to get the complete story, Berkshire Hathaway's first-quarter operating results show that a sizable chunk -- about 115 million shares -- of the company's stake in tech stock Apple(NASDAQ: AAPL) was given the heave-ho.<br /><br />In addition to Berkshire's operating results spilling the beans, Buffett freely admitted during his company's annual shareholder meeting that he and his investment team pared down this mammoth stake in the March-ended quarter. He justified this reduction by pointing to corporate tax rates. Buffett opined that investors would come to appreciate Berkshire locking in gains at a 21% peak corporate tax rate given the likelihood that corporate tax rates rise in the future.<br /><br />Despite jettisoning around 13% of his company's stake in Apple, Warren Buffett still views the company as Berkshire's best business.<br /><br />Apple has an exceptionally loyal base of customers, and it's frequently led with innovation. CEO Tim Cook has successfully overseen the development of domestic market share-leading iPhones, as well as Apple's transformation to a platform's company.<br /><br />But if you asked Warren Buffett what his favorite thing is about Apple, it might very well be the company's unsurpassed capital-return program. Apple is on track to dole out a little over $15.4 billion in dividends to its shareholders this year, and has repurchased $674 billion worth of its common stock since initiating a buyback program in 2013. Buffett loves buybacks because they can incrementally increase the ownership stakes of long-term investors.<br /><br />However, Apple isn't immune to headwinds. Following a modest sales decline in fiscal 2023 (Apple's fiscal year ends in late September), the second-largest public company by market cap has seen its net sales slip by less than 1% through the first half of the current fiscal year. While subscription services revenue has been strong, physical product sales remain weak.<br /><br />Furthermore, while modest cost-cutting and an aggressive share repurchase program have kept earnings per share (EPS) moving in the right direction, a deeper dive into Apple's net income shows the company's growth engine has stalled.<br /><br />Apple was a bargain when it was delivering sustained double-digit sales growth and trading at a multiple of 10 to 15 times forward-year EPS. But at 27 times forward-year EPS and with sales going nowhere, this Wall Street darling looks to be losing its sheen.<br /><br />Should you invest $1,000 in Nvidia right now?<br /><br />Before you buy stock in Nvidia, consider this:<br /><br />The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.<br /><br />Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $550,688!*<br /><br />Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. TheStock Advisorservice has more than quadrupled the return of S&P 500 since 2002*.<br /><br />See the 10 stocks »<br /><br />*Stock Advisor returns as of May 6, 2024<br /><br />Sean Williams has positions in Intel. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Berkshire Hathaway, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.<br /><br />3 Ultra-Popular Stocks Billionaire Investors Are Selling was originally published by The Motley Fool<br /><br />View comments",],

"source": [

"https://finance.yahoo.com/news/iphone-exports-india-double-predicted-113756676.html",

"https://finance.yahoo.com/news/warren-buffetts-189-billion-subtle-084100685.html"],

"publicationDate": [

1715572800,

1715572800],

"updated": 1715572800

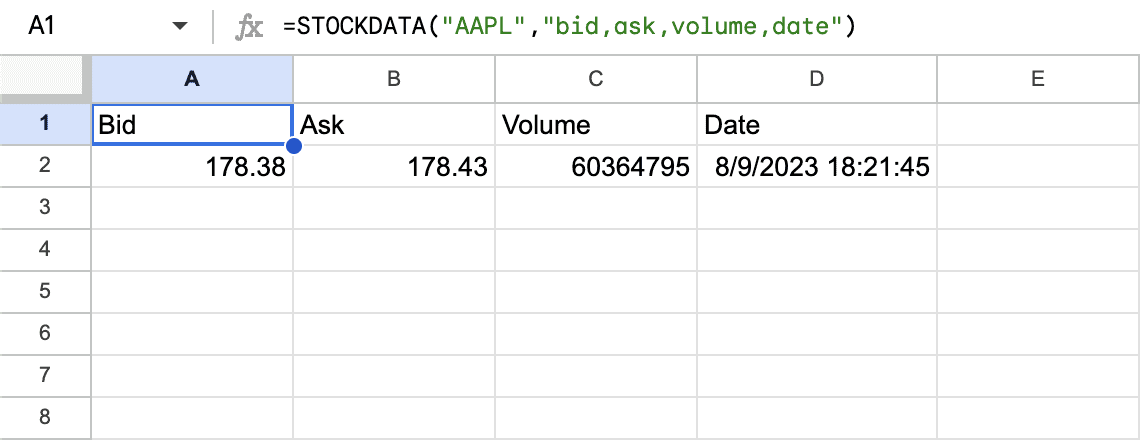

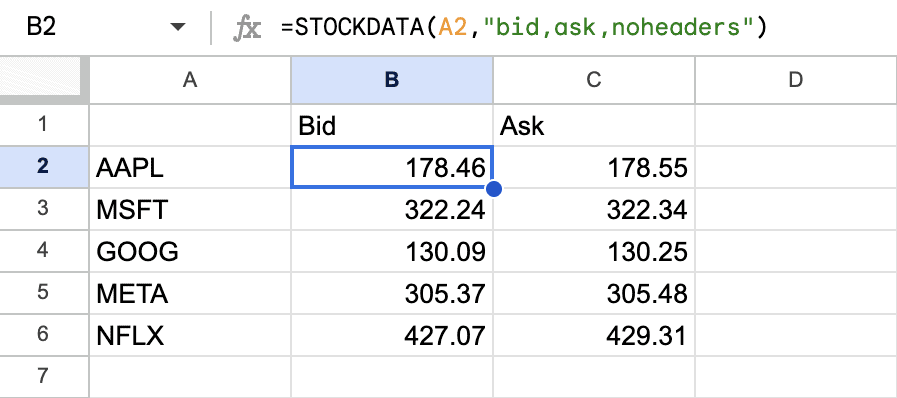

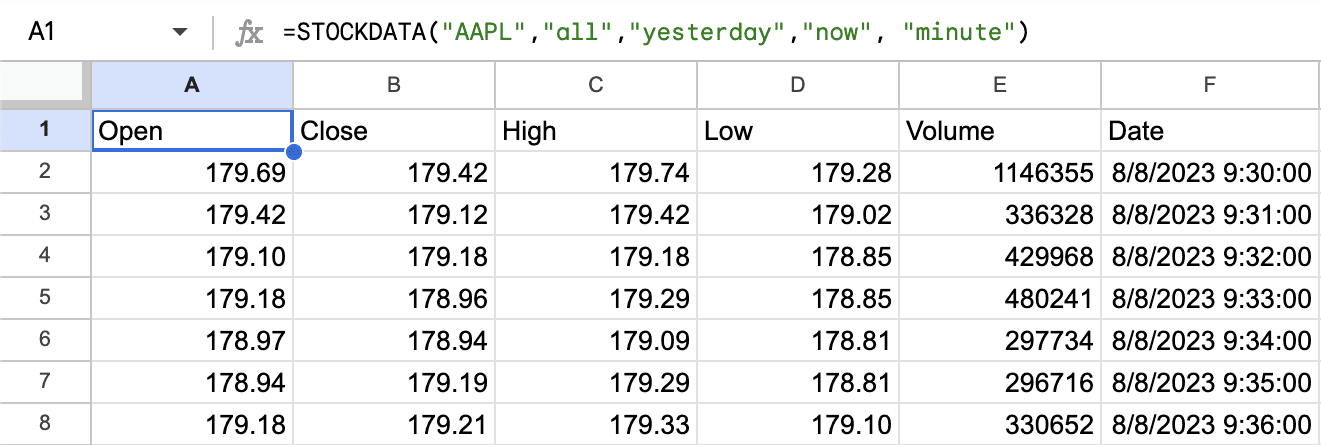

}The STOCKDATA Formula

One Formula For Real-Time + Historical Data

Designed for both real-time insights and in-depth historical analysis, STOCKDATA is fully configurable and provides a comprehensive view of market movements. Resolutions down to the minute and real-time quotes are supported.

Frequently Asked Questions

This section explains how our stock data works—what’s included, how it’s sourced, and the types of access available.

Browse the questions below to learn more about our stock coverage, including supported exchanges, timeframes, extended hours, and historical depth. If you have specific needs not covered here, feel free to reach out to our sales team.

Where does the real-time stock data come from? Is it sourced directly from the exchanges?

Our real-time data comes from the Investors Exchange (IEX), one of the 16 U.S. stock exchanges. IEX publishes real-time quotes and trades for thousands of U.S. exchange-listed stocks—including popular symbols like SPY, QQQ, AAPL, TSLA, NVDA, and more. This data is fast, high-quality, and available without exchange fees for personal and non-commercial use.

Will I see real-time prices for stocks that don’t list on IEX?

Yes. In the U.S., stocks can trade on multiple exchanges, not just the one they’re listed on. For example, NVDA is listed on NASDAQ, but it also trades on NYSE, IEX, and other venues. The same goes for TSLA, AAPL, and all major stocks. IEX handles trades for nearly all actively traded U.S. stocks and ETFs, and it publishes real-time quotes and trades for them. That means you’ll still get live, real-time updates for these stocks—even if they’re officially listed on the NYSE, Nasdaq, or elsewhere.

Is the data the same for the spreadsheet and the API?

Spreadsheet users receive real-time stock quotes directly from the IEX exchange—offering true exchange-sourced pricing at an unbeatable value. This makes it ideal for personal dashboards, research models, and custom tracking tools where fast, reliable data matters.

API users receive Smart Mid, our proprietary real-time pricing model designed to reflect fair market value with greater precision than a simple midpoint. Smart Mid adjusts dynamically based on top-of-book order size, recent trades, and quote activity—providing a fast, liquidity-aware estimate of the current real-time price. It is derived from IEX data and offers a reliable, high-performance solution for personal and non-commercial use.

Do you offer pre-market and after-hours data?

Yes, we include both pre-market and after-hours trading data for all the stocks we support. You can access it through the API or directly in Google Sheets using our add-on.

How far back does your historical data go?

We offer historical stock data going back to 2010. For some stocks, data may be available further back, depending on the symbol.

Is the data adjusted for splits and dividends?

By default, intraday data is provided as traded, and daily data is split-adjusted. However, you can request either format—split-adjusted or raw—for both daily and intraday data, depending on your needs. Dividend adjustments are not currently supported.

Do you offer consolidated tape data or exchange-specific feeds?

We offer historical candlestick data based on the full SIP (consolidated tape), giving you accurate price and volume data that reflects activity across all major U.S. exchanges. It’s a reliable foundation for research, backtesting, and long-term analysis.

We do not currently offer real-time SIP feeds or direct exchange-specific feeds. Instead, our real-time coverage is built around two solutions: IEX-sourced quotes in spreadsheets and our Smart Mid model in the API, which estimates real-time pricing based on top-of-book activity.

Our goal is to offer high-quality market data at accessible pricing for individual users. As we grow, we plan to expand our real-time offerings—adding consolidated and exchange-specific feeds where it makes sense technically and economically, without compromising affordability.

How often is candlestick data refreshed?

Our candlestick data — both daily and intraday — is based on official exchange data and is typically delayed by up to 15 minutes to comply with exchange distribution rules.

We also provide real-time stock quote data for paid users, giving you access to the latest market prices when needed.

Because candlestick data reflects slightly delayed exchange information, the “close” price of a candle may not match the real-time “last” price from a quote at any given moment.

Candlesticks are refreshed continuously during market hours using the latest available official data, ensuring consistent and reliable pricing.

If you need the most current trade information, we recommend using our real-time quote formulas or endpoints alongside candlestick data.

How do you handle symbol changes or delistings?

Our historical data reflects each symbol exactly as it was traded on a given date. If a company has changed its ticker or been delisted, you’ll need to use the symbol that was active at the time. We include data for most delisted stocks, making it possible to analyze long-term histories—even across corporate actions. While we don’t currently offer a built-in symbol change tracker, you’re free to integrate one externally to support your workflow.

Get Data Anywhere

How would you like to receive your data? Let's get started.

Market Data API

Our RESTful API allows on-demand access to our entire data catalog. With a single subscription plan, get access to both real-time and historic data on whatever instrument you need.

Google Sheets Add-on

Use simple formulas based on GoogleFinance to download market data directly into your Google spreadsheets. Both real-time and historical data is available.